Butler National Corp ($BUKS)

The A to Z quest where I go through all OTC stocks and write about ones that I find interesting

Butler National Corp is one of the larger companies we have profiled in the OTC A-Z edition. It has been public since 1995. Their life as a public company is just 5 years younger than me and has operated out of Kansas, US for all its life. Butler has 2 businesses that you wouldn’t typically see together - Aircraft modification & services, and Casino Management.

Summary

Butler trades in OTC markets at a market cap of $106M, CMP $1.51 per share (8 times TTM Operating Income). Butler manages the Boot Hill Casino based out of Kansas and that is a stable, high margin business with minimal cap-ex. The casino business generates around $7-8M in operating income ($5-6M est. post-tax net income), with $38M in FY24 revenues. However the negative is that this business is likely to grow at best with inflation unless gambling footfall magically increases in Kansas.

The aircraft modification business is more volatile one but is niche. The operating margins range between -3% to 18% over the last ten years. Embedded in this business is also an aircraft buying and selling business where Butler buys an aircraft, modifies it and then sells it. The positive on this one is that it has been growing topline at 9% over last 10 years.

As you probably guess, the story of this company is hard to define. The combination of aircraft modification and casino is not lending itself to any synergies. Will they sell the casino business? Where is this business going? Could this become one of those value traps? No idea.

So why are we interested?

They got a new CEO in 2023 and the first thing he did was a $5M buy-back. The company has never bought back stock or paid dividend till last year in their entire 30 years of existence as a public company.

Stock quickly rallied from $0.70 per share to $1.50. The new CEO has been with Butler for last 25 years and served as COO recently before becoming the CEO. The board has started to change. They brought in Joseph Daly (10%+ owner) who also incidentally is a director in Autoscope Tech ($AATC), which we covered earlier. They got a retired director of US Air National Guard which makes sense given US Defence is one of their big customer. Daly has been consistently buying BUKS shares in the open market since 2023 (Activism?).

The company is in early stages and it is anybody’s guess where BUKS will go. But we know one thing for certain - This is not the sleepy dreary company that it was for last 30 years.

Aerospace Business

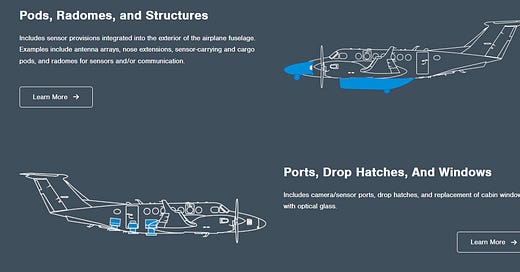

It would be good to talk about what Aircraft modification is. These are modifications to existing aircrafts to enhance their stability, storage capacity or mounting other equipment on them. Like these:

This is a highly regulated industry. To make modifications, one would require authorisation from Federal Aviation Authority (FAA), who would issue a Supplemental Type Certification (STC) for every modification/part that one can make or service in an aircraft. Butler has more than 250 of these STCs currently. These certifications are not easy to come by either. Butler mentions instances of them investing in prototypes and fitting them on aircraft to showcase the safety. And they have been doing this for last 30 years.

We own over 200 STC's. When the STC is applicable to a multiple number of aircraft it is categorized as Multiple-Use STC. These Multiple-Use STC's are considered a major asset of the Company. Some of the Multiple-Use STC's include the Beechcraft Extended Door, Learjet AVCON FINS, Learjet Extended Tip Fuel Tanks, Learjet Weight Increase Package and Dassault Falcon 20 Cargo Door.

Source - 1995 10-K

These STCs have to be procured for each part and aircraft model separately. That means they have to go through FAA approval process for each of those certificates separately. And most of these enhancements, modifications and services are done for aircrafts already in service, to prevent obsolescence. BUKS typically cater to the smaller ones (Lear Jets) and legacy aircrafts.

History of Aerospace business

Aerospace is the legacy part of the Butler National business, organized over 50 years ago. These new products included: in the 1960’s, aircraft electronic load sharing and system switching equipment, a number of airplane electronic navigation instruments, radios and transponders; in the 1970’s, ground based VOR navigation equipment sold worldwide and military GPS equipment as we know it today in civilian use; in the 1980’s, special mission modifications to business jets for aerial surveillance and conversion of passenger configurations to cargo; in the 1990’s, classic aviation support of aging airplanes with enhanced protection of electrical systems through transient suppression devices (TSD), control electronics for military weapon systems and improved aerodynamic control products (Avcon Fins) allowing stability at higher gross weights for additional special mission applications; in the 2000’s, improved accuracy of the airspeed and altimeter systems to allow less vertical separation between flying airplanes (RVSM) and acquisition of the JET autopilot product line to support and replace aged electronic equipment in the classic fleet of Learjet airplanes; and in the 2010’s, the acquisition of Kings Avionics to provide additional classic airplane support by retrofit of avionics from the past 40 years to modern state of the art equipment for sale worldwide using FAA supplemental type certification to make the installations (STC) acceptable to foreign governments for installation abroad.

Aerospace business has been around since 1996 and just from a glance below, you can appreciate how consistently revenue and backlog has grown.

But the squiggly operating income will tell you how volatile the business is. However, since 2019, the growth in aerospace business has been phenomenal despite covid headwinds. Large part of this growth was due to a new FAA regulation enacted in 2017

…to address the current Federal Aviation Administration ("FAA") and international system requirements for Automatic Dependent Surveillance - Broadcast ("ADS-B"). ADS-B is a precise satellite-based surveillance system. ADS-B Out uses GPS technology to determine aircraft location, airspeed and other data, and broadcasts that information to a network of ground stations, that relays the data to air traffic control displays and to nearby aircraft equipped to receive the data via ADS-B In.

We currently have FAA approved Supplemental Type Certificates allowing the installation of four different configurations of ADS-B systems. ADS-B will be required on the majority of all civil aviation aircraft by January 20, 2020. We are selling and installing ADS-B system solutions at Butler Avionics and Avcon.

FAA regulations does not stop here. They have been enacting more regulations which legacy aircrafts need to comply with. These regulations typically ensure the legacy ones are still airworthy and safe to travel. Some estimates that there are still around 30% of aircrafts without ADB-S system. Looking at all this, I think there is runway for growth in this business.

Casino Management Business

In the early 1990’s, management determined that more revenue stable business units were needed to sustain the Company. Members of the Board of Directors had contacts with several American Indian tribes, others members were associated with gaming operators in Las Vegas.

In 2007, BNSC made application to manage a state owned casino. In 2008, BNSC was awarded a fifteen year contract to manage the Boot Hill Casino and Resort in Dodge City, Kansas. BHCMC was organized to be the manager of the casino in Dodge City. The casino opened in December 2009.

This business is very different from the Aerospace business. Stable revenues, Margins have increased since 2020, and I think it is largely from operating leverage. BUKS does not own the Casino. They lease the building, manage it. Given this is a single casino located in Kansas, there is some inherent risk in this business. When I say gambling, you might think of Las Vegas or Atlantic city. Definitely not Kansas. Definitely not Dodge City, few hours from Wichita. Add to that the constant refurbishment capex, labour costs. To me, this is an unattractive business even though revenues are stable and margins are high. If they were to sell this off, it might fetch $60-80M, depending on how appreciative the market is. But the bottom line is it has to be sold.

Conclusion

I think by now you have a flavour for this business and what is interesting here. I am cautiously optimistic for BUKS and what is to come. As the business gets tidied up, it will be discovered and there could be price appreciation. The new CEO is only 58 years young. There are new FAA regulations to comply which means the money register will be humming, if not singing, for next few years.

Congratulations if you have made it so far! I truly appreciate that you have taken time out to read what I wrote. If this post made you happy, feel free to let me know :)

Good summary, would love to know of any competitive advantages or an attempt at estimating run-rate cash flows (especially for the aircraft modification business). Ultimately, I don't have any confidence in the business going forward, I think land-based casinos have huge digital headwinds and unless the aircraft modification business gets acquired I don't see a LT niche for them, so it's an easy pass for me.