Nanocap trading at 83% of its cash, 50% to Book Value

A decade of profitability, 23% insider ownership

Welcome to the A to Z series where I write about underfollowed & undervalued OTC stocks that I find by going through all the stocks in OTC Markets from A to Z.

Before we get to the show, please remember - None of this is investment advice. Please do your own due diligence prior investing.

Let us play a game of - How much would you pay for this company?. Here are some clues:

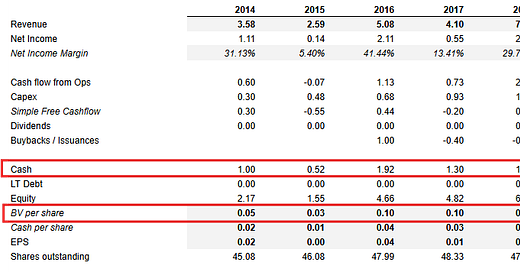

This company’s revenues were $7.5M & $5.4M in 2024, 2023

Over its 11 year history, the average net income margin was 23% (No losses)

No debt

Cash per share is $0.25

Book value per share is $0.41 (22% CAGR over 11 years)

Share count has stayed constant over last 5 years

Surely you would ask, “But Mr Unfair, what does this company do?”. Let us park that question aside for a brief moment.

Would you be willing to pay $0.40 per share? $0.30 per share if you are stricter? Maybe. Those would still be bargain prices.

But this company is available to you at a grand price of $0.21 per share.