Occidental Petroleum [$OXY]

"We are not in the oil discovery business. We are in the oil recovery business" - Chazen, ex-CEO, Occidental

[PSA] We are going paid! Paid subscribers will have access to all historically posted & future stock analyses at $9.99 per month.. Deep-dives will be detailed analysis of companies in US, EU or India. It will save you hours worth of pouring over 10Ks, 10Qs etc. and instead give the research in a condensed long-form article.

Table of Contents

Understanding OXY

OXY’s business history & current operations

Enhanced Oil Recoveries - A primer

History of Permian Basin

Analysing OXY’s acquisitions

Elk Hills

Altura Energy

Anadarko

Learning from the acquisitions

Crown Rock Acquisition

Value Creation Framework

Carbon Capture - OXY’s low-risk optionality

Capital Allocation & Management

Moats of OXY castle

Investment Thesis

Valuation - Is it a buy?

Risks

Conclusion

OXY’s business history & current operations

Oxy was founded in 1920s and was a largely unprofitable small driller till Armand Hammer bought a controlling stake in 1950s. In 1956 Hammer and his wife Frances each invested $50,000 in two oil wells that Occidental planned to drill in California. When both wells struck oil, Hammer took an active interest in further Occidental oil exploration. Oxy, under Hammer, had a bit of chequered past with scaling to a prominent oil player at the same time mired in issues such as bribing Libyan officials for concessions. Under Hammer, Oxy diversified into multiple sectors like chemicals, fertilisers and even owned a meat packer at one point! Hammer treated Oxy as his personal fiefdom for all practical purposes, despite owning only 1% by 1990s.

Post Hammer’s death, he was replaced by Dr. Ray Irani, a chemical engineer who brought Oxy’s focus back to Oil. Ray immediately divested all non-core assets and expanded Oxy deeper in to middle east. His Lebanese heritage helped form key-relationships in Middle East and Oxy vastly expanded in middle-east. When Libya’s sanctions were lifted in early 2000, Oxy was the first one there getting concessions for oil-fields.

By 2008-09, shareholders were increasingly worried that Ray was paying himself exorbitant amounts as CEO. He was the highest paid executive even amongst oil cos and awarded himself close to $730M in stock options. By 2010, shareholders voted to fire Ray and he was replaced by his CFO - Steve Chazen, who was instrumental in bringing Oxy’s focus back to domestic assets.

Chazen set the strategy that Oxy would continue following till present date under Vicki Hollub. It was simple - Look for more oil where it is already known to exist & focus mainly on Permian. We will revisit this playbook that Oxy has been continuously deploying for decades.

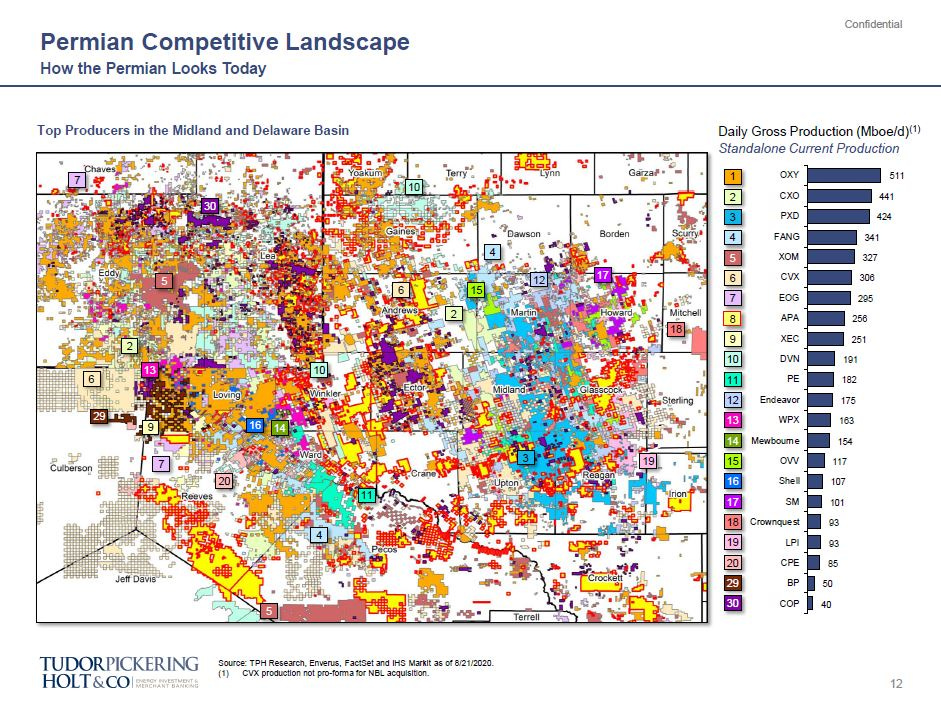

Currently Oxy is the largest producer in Permian Basin, owning 8% of total Permian production. Occidental in its current form has 3 principal businesses: oil and gas, chemical and midstream. The oil and gas segment explores , develops and produces oil (which includes condensate), NGL and natural gas. The chemical segment manufactures basic chemicals and vinyls. The midstream and marketing segment gathers, processes, transports and stores oil, NGL, natural gas, CO2 and power. It also optimises its transportation and storage capacity, and invests in entities that conduct similar activities. Given that more 80% of Oxy’s current profits and revenue come from oil, we will mainly focus on their oil-business for the rest of the thesis.

Unlike other drillers, Oxy has always preferred to hold long-lived legacy assets with enhanced secondary, tertiary recovery properties vs brand new oil fields. It would be useful to take a detour to explain what is secondary, tertiary recovery.

Enhanced Oil Recovery - A primer

Typically, in any oil well, crude gets pushed from sub-surface to top due to the inherent pressure build up in the well. This pressure in effect is released by the drilling and oil comes up. However this pressure does not push all the oil out & sometimes if rock is not porous enough, this oil gets trapped in the rocks.

As the pressure difference between the well and atmosphere reduces, the flow begins to come down. In this setting, we use enhanced oil recovery methods such as pumping water or CO2 into the well, which will in effect ‘push the remaining oil’ up, thus extending the life of the well. CO2 reduces viscosity (‘stickiness’) of oil which helps bring it out easily.

Although Permian Basin was recognised as a ready candidate for CO2-based EOR due to its favourable rock structure, it was not until late 80s when CO2 pipelines were laid bringing down the costs of EOR.

OXY has historically purchased long-lived legacy assets in Permian Basin, applied EOR techniques to improve yield & economics in these fields. Currently OXY has over 2500 miles of CO2 pipeline (one of the largest CO2 pipeline owners), in-house supply of CO2 via Bravo Dome. For competitors to start their EOR process, they would have to invest in building these pipelines, or buy CO2 which we estimate would easily be $2.-2.5B worth of CO2 for size of OXY’s operations.

History of Permian Basin

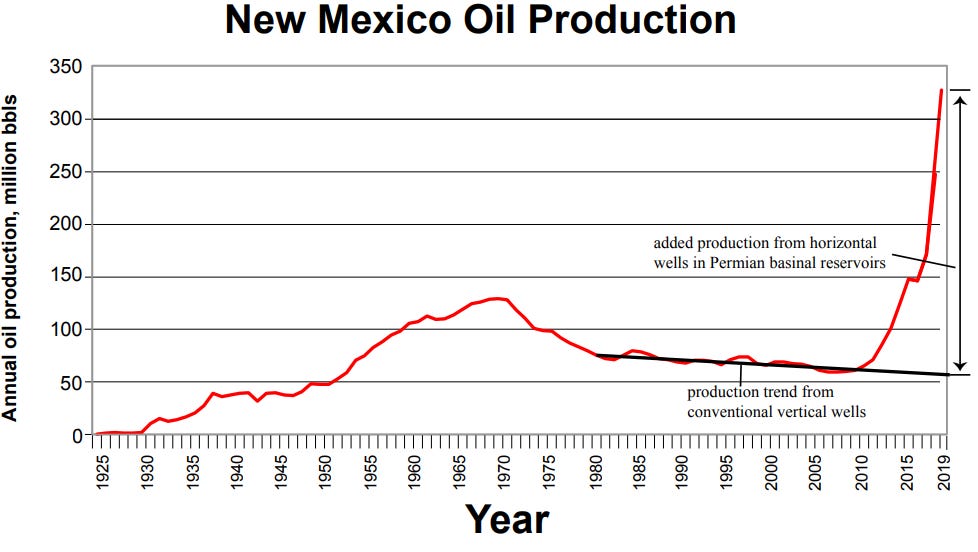

Permian basin is the largest oil field in United States both in acreage and production. Spanning over 86,000 square miles across Texas & New Mexico, Permian Basin contributed close to 35% of US Crude Oil Production in 2019. Much of this increase came post 2009, due to technological improvements in hydraulic fracking, horizontal drilling and enhanced oil recovery methods. Even though shale-wells have much lesser lifetime (1-1.5 years), over 50% of current US oil production comes from shale, making it a critical strategic resource.

Oil in Permian was discovered only in 1922. Till then, Permian was largely considered a graveyard, a haven for dry-holes. Population was sparse, land was arid and there was no transportation facilities. Back in late 1800s, transportation and refining was 2/3rd the price of oil. So oil prospectors generally avoided West Texas areas.

Permian Basin is a story of technology. As technology improved, so did the production in Permian, the reserves that can be extracted & the economics of drilling in Permian. Despite being a 100 year old oil field, Permian is still the largest producer of Oil in US with several decades of reserves still left. And this has been closely linked with technological development in drilling.

Recently, the United States Geological Society (“U.S.G.S.”) evaluated the potential of one formation in the Permian Basin, the Wolfcamp shale, and estimated a potential recovery of 20 billion barrels of oil and 1.6 billion barrels of natural gas liquids. To put this in perspective, the massive East Texas Oilfield—the largest conventional field ever discovered in the lower 48 states—will produce roughly 5.5 billion to 6.0 billion barrels of oil when it is ultimately depleted. Permian has a long way to go before depleting.

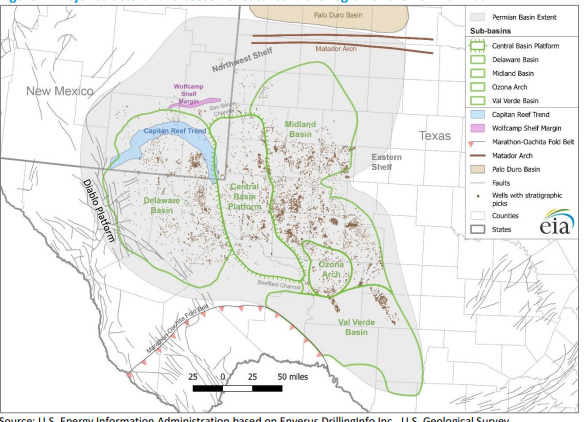

Permian consists of 3 sub-basins. Entirely located within Texas, on the eastern edge is the Midland Basin. On western edge, located in New Mexico is the Delaware basin. Between Midland Basin and Delaware is Central Basin. Hydrocarbon deposits in Permian is usually a mix of oil & natural gas. There are few deposits with predominantly natural gas but those are a minority.

Permian Basin predominantly has shale formations, with the wells having longer horizontal components. Think of these wells spanning long stretches horizontally and stacked on top of each other. Because of the geology, some geologists describe the Permian Basin geology as a layer cake of stacked potential producing formations.

The benefit of stacked layers is, drillers can locate multiple wells at one surface location and drill from that site to different depth horizons. This procedure reduces surface damage and substantially increases drilling efficiency since a series of well-bores can be drilled by skidding the rig a few feet in one direction or another on the pad. Maximizing efficiencies and minimizing costs of surface facilities—such as pipelines, tanks, separators, and compressors.

Recently, drillers have developed technology to drill horizontally to tap into more oil wells from a single location. This allows drillers to reach more inaccessible location with vertical drilling, access more wells from single location. Once drilled, they use hydraulic fracking to break these shale formations to extract oil and natural gas especially in Permian’s stacked layer geology.

As technology improved, we are now able to access previously inaccessible sources of oil in Permian. One method is going longer distances laterally. From 3000-5000ft, drillers are now going up 15000ft - drilling 2-3 miles deep and then, drilling 2-3 miles horizontally. Longer lateral drilling have more advantages. Till recently, 2-3 mile lateral distances were inefficient economically. But with modern equipment and completion methods, 15000 ft drilling has become possible. They are capital efficient, lowers break-even cost of drilling. Longer laterals cut drilling time, resources to move rigs and crew (once a well is depleted) and requires lower upfront capital.

However, one big requirement for longer lateral drilling is large swathes of contiguous acreage. Occidental has 1.4 million net acreage (excluding Crown Rock) in Permian. Second largest player, Pioneer Natural Resources has close to 844,000 acres. This partly explains the latest land-grab acquisitions in Permian basin (Exxon - Pioneer, OXY - Anadarko, Crown Rock).

From a S&P article on longer lateral distances:

According to Daryl Koo, head of oil asset intelligence for energy consultancy Enverus, in the core Delaware Basin Wolfcamp-A formation, the breakeven WTI price of a well decreases from $38/b to $34.50/b when going from 5,000 foot to 10,000 foot laterals.

"Though we didn't model a 15,000-foot case given it's still an emerging design, I'd expect the breakeven price to further decrease to around $31-$33/b, assuming no major issues with production or cost performance," Koo said.

As of 2020 , OXY is the largest producer (orange dots in map below) in Permian with vast swathes largely contiguous land. It is closely followed by Pioneer (acquired by Exxon), which are the blue dots.